Are Your Commercial Buildings Underinsured?

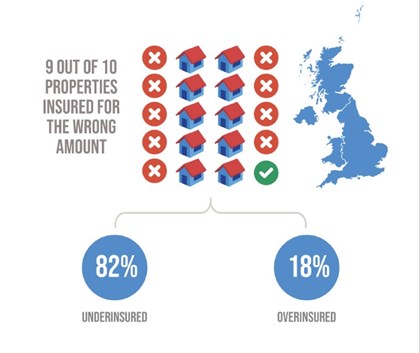

At least 90% of commercial properties in Britain are either over or underinsured. Over insurance generally means paying excessive premium for no tangible additional benefit, however underinsurance is much more common and can have more severe consequences.

Who is Most at Risk from Underinsured Commercial Buildings?

Whilst the need for adequate building and contents insurance cover is well known, many businesses across the UK are at risk of underinsuring their commercial buildings. This is due to the common mistake of using the market value for the property when obtaining commercial insurance cover, rather than the actual cost to rebuild the property and replace all of its contents.

More than 70% of properties in the UK are covered for less than two thirds of their correct rebuild cost. This leads to disputes with insurers, with claims payments being reduced by considerable sums. In the worst case, the insurance provider may not pay out at all, if there is excessive deviation from the correct rebuilding / replacement sums insured.

To ensure your property is adequately protected, its rebuild cost needs to be professionally assessed. This can be both time-consuming and expensive to conduct, but if done correctly, it will consider the following information:

- Demolition and property clean-up costs, where necessary

- Cost of property rebuild from scratch including labour and materials

- Value of fixtures and fittings

- Value of stock or other contents

How Can Abbey Bond Lovis Help?

ABL Group can arrange a Rebuild Cost Assessment which is accurate and cost-effective, a no-hassle service delivered to you.

At a very competitive cost, ABL Group working alongside RCA Ltd. can provide a comprehensive Rebuild Cost Assessment (RCA) report without even having to visit your property. This is a far more efficient and affordable service compared to some other providers and is known as a desktop assessment. It uses a unique combination of information technology and staff expertise to provide a trustworthy assessment of your building’s rebuild cost.

Thanks to an innovative approach, our partner can also offer a premium face-to-face site assessment at an unbeatable price. This combines both desktop technology and an onsite evaluation for even greater accuracy.

Whatever the selected method, it is absolutely vital that your property is insured for the correct amount. This will make sure you are not over or under-insured and minimise the risk to your business in the event of a claim being made.

In addition, the Rebuild Cost Assessment will provide the estimated rebuild period which assists with a more accurate Business Interruption sum insured. This protects the business during periods of downtime, when the cause was beyond the owner’s control or resulting from a natural disaster.

About Our Partner: RCA Ltd.

Our property assessment partner, Rebuild Cost Assessment Ltd (RCA Ltd.) is a professional organisation which is ‘Regulated by RICS’ (Royal Institution of Chartered Surveyors). Their approach to insurance valuations is making property Rebuild Cost Assessments far more affordable and easier for businesses today to access. RCA Ltd offer both desktop and on-site assessments in a timely manner to help you when it comes to correctly insuring your commercial property and contents.

To arrange your commercial buildings insurance or check if you are underinsured, contact ABL Group today:

Phone us: 028 9099 3600

Email us: info@ablinsurance.co.uk

Note: The above graphics have been supplied by RebuildCostAssessment.com and derive from an assessment of over 8,863 property Rebuild Cost Assessments carried out by Rebuild Cost Assessment between September 2018 and August 2019.